st louis county personal property tax calculator

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care. These calculators are not intended to be used by the political.

County Assessor St Louis County Website

Write the Assessment Number s being paid on your Check or Money Order.

. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Enclose Payment Stub s. Louis City collects on average 092 of a propertys assessed fair market value as property tax.

Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802. Change Taxpayer Mailing Address. Ad The Leading Online Publisher of National and State-specific Leases Legal Documents.

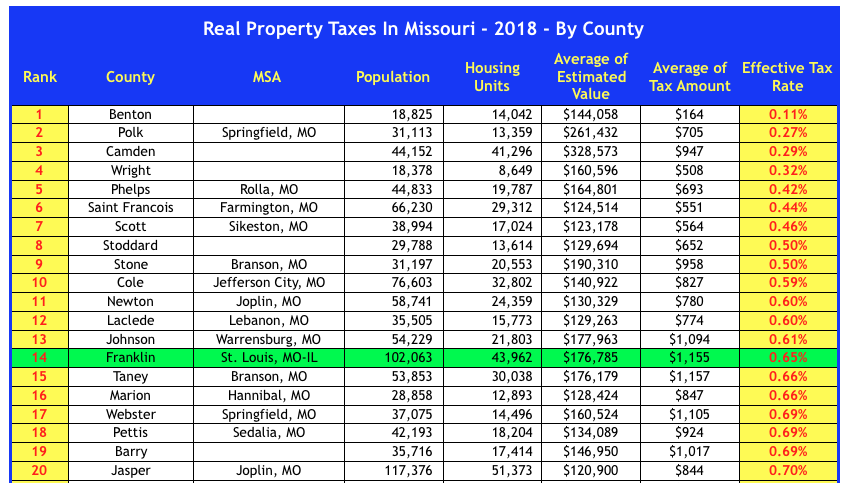

This eastern Missouri county has among the lowest property tax rates of any county in the St. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Missouri and across the entire United States. The median property tax in St.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. To declare your personal property declare online by April 1st or download the printable forms. San Luis Obispo CA 93408-1003.

The following calculators can assist you with the calculating the 2022 property tax rate or revised 2021 property tax rate if necessary. May 15th - 1st Half Agricultural Property Taxes are due. Louis County collects on average 125 of a propertys assessed fair market value as property tax.

Account Number number 700280. Louis County Missouri Property Tax Go To Different County 223800 Avg. Find Your County Online Property Taxes Info From 2022.

This eastern Missouri county has among the lowest property tax rates of any county in the St. November 15th - 2nd Half Agricultural Property Taxes are due. Louis County for example the average effective tax rate is 138.

Monday - Friday 800am - 500pm. Please contact the State Auditors Tax Rate Section if you have any questions regarding the calculation of property taxes at 573-751-4213. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Minnesota and across the entire United States.

2022 Cost of Living Calculator for Taxes. County Tax Collector or SLOCTC 1055 Monterey St Room D-290. Personal Property Tax Use Receive Code 12031 and Mobile Home Property Tax.

Account Number or Address. 125 of home value Yearly median tax in St. Louis Missouri are 35 cheaper than Athens-Clarke County Georgia.

Change Taxpayer Mailing Address. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. Missouri is ranked 1301st of the 3143 counties in the United States in order of the median amount of property taxes collected.

In Shannon County the rate is just 035. Louis City Missouri is 1119 per year for a home worth the median value of 122200. The median property tax in St.

The reports are shown in the table below. Additional methods of paying property taxes can be found at. An original or copy paid personal property tax receipt or a statement of non-assessment from your county of residence or city of St.

Programs to help with Taxes. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Mail payment and Property Tax Statement coupon to.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Charles County pays 2624 annually in property taxes the third-highest amount of any county in Missouri. To use the calculator just enter your propertys current market value such as a.

Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of. If paying by mail please make the check payable to. Ad Receive Local Property Records by Just Entering an Address.

W Room 214 Duluth MN 55802-1293 Pay your taxes. Louis County Auditor 100 N. Louis County Auditor St.

Programs to help with Taxes. Athens-Clarke County Georgia and St. City Hall Room 109.

Louis County The median property tax in St. November through December 31st you may also drop off your payment in the night deposit box at one of four Commerce Bank locations. Personal Property Tax Department.

You pay tax on the sale price of the unit less any trade-in or rebate. Subtract these values if any from the sale. Louis County Courthouse 100 North 5th Avenue West Duluth MN 55802.

The Property Tax Reports give detailed information to help determine your property tax amounts. Sign Your Check or Money Order.

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

Online Payments And Forms St Louis County Website

County Assessor St Louis County Website

County Assessor St Louis County Website

2022 Best Places To Buy A House In St Louis Area Niche

Amazon Com St Louis County Missouri Zip Codes 36 X 48 Paper Wall Map Office Products

Amazon Com St Louis County Missouri Zip Codes 36 X 48 Paper Wall Map Office Products

Revenue St Louis County Website

Online Payments And Forms St Louis County Website

St Louis County Inner Ring North Puma Mo Data Usa

County Assessor St Louis County Website

County Assessor St Louis County Website

Missouri Has One Of The Highest Vehicle Property Tax Rates In The Nation Lake Of The Ozarks Politics Government Lakeexpo Com